Monthly Housing Update

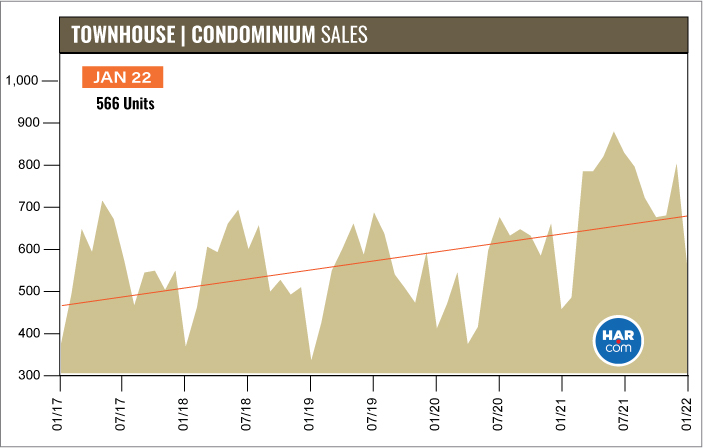

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

HOUSTON REAL ESTATE KICKS OFF 2022 WITH A SOLID PERFORMANCE

The $1M+ housing segment dominates January sales, home prices continue to rise, and inventory remains low

HOUSTON — (February 9, 2022) — The Houston real estate market charged into the new year carrying the positive momentum it sustained throughout 2021, with the strongest sales activity at the highest end of the pricing spectrum because there is little to no inventory available below the midrange. With an inadequate supply of new listings to meet consumer demand, inventory overall remains at historic lows, and steady pricing increases coupled with rising mortgage interest rates create uncertainty over what lies ahead for the market in 2022.

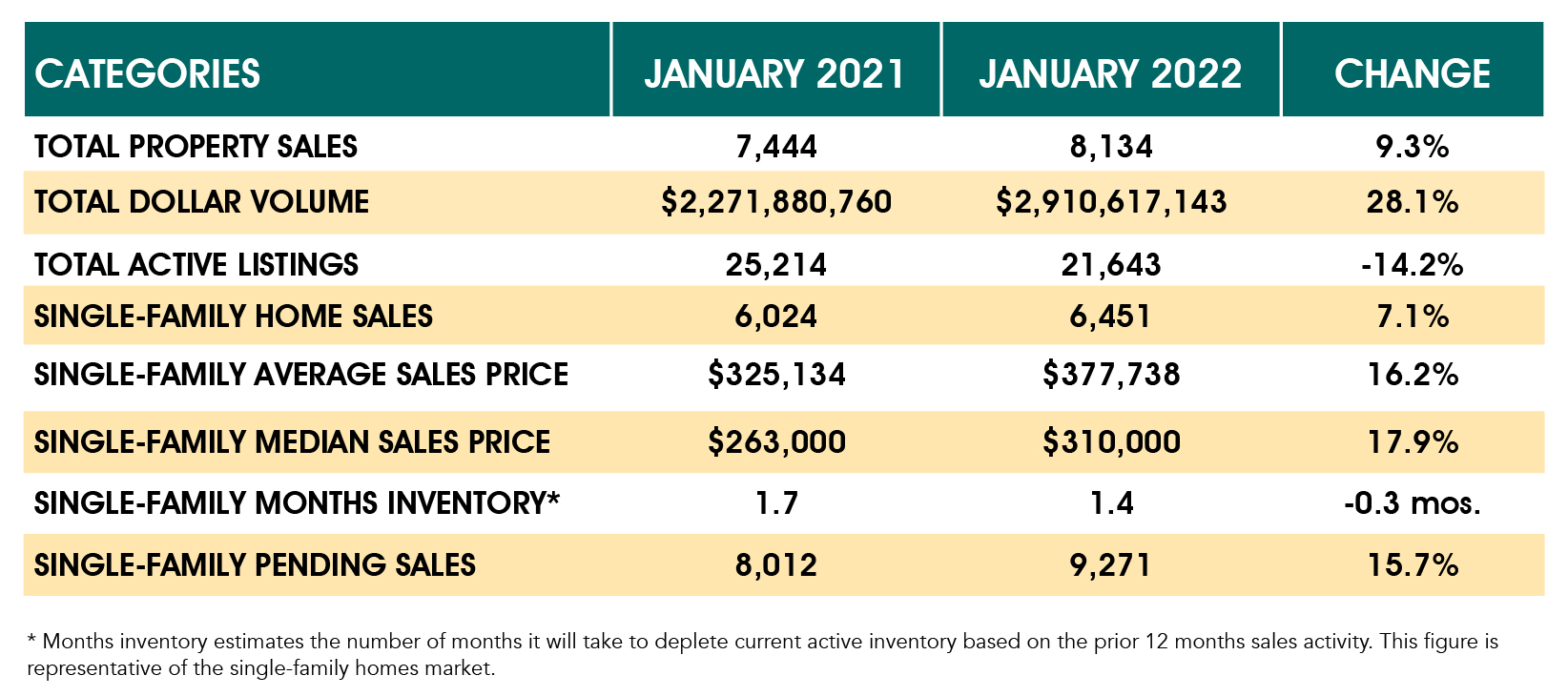

According to the Houston Association of Realtors (HAR) January 2022 Market Update, single-family home sales rose 7.1 percent with 6,451 units sold compared to 6,024 in January of 2021. Renters also kept the lease market in positive territory in January.

Homes priced from $1 million and above drew the greatest sales volume increase for the month, registering a 52.2 percent year-over-year gain. The $500,000 to $1 million housing segment came in second place, surging 47.1 percent. That was followed by homes priced between $250,000 and $500,000, which rose 36.1 percent.

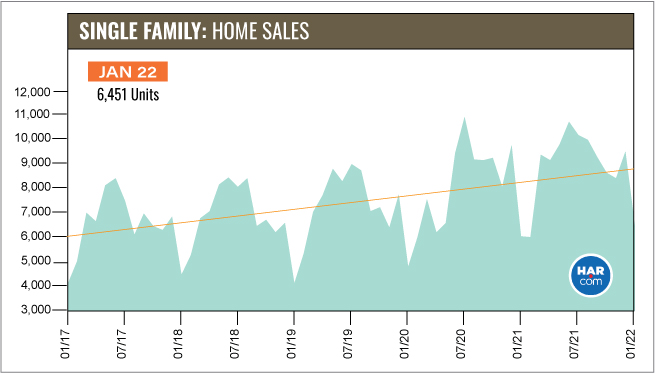

Once again, the heavy volume of high-end buying and lack of inventory of homes under $250,000 pushed overall prices upward. The average price of a single-family home rose 16.2 percent to $377,738 while the median price shot up 17.9 percent to $310,000. While both figures represent highs for a January, they are well below the historic highs reached last year.

Sales of all property types were up 9.3 percent year-over-year, totaling 8,134, and total dollar volume for January jumped 28.1 percent to $2.9 billion.

“The Houston housing market staged an impressive start to 2022, but that pace of sales is unsustainable without dramatic and immediate improvement in inventory,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “There simply aren’t enough homes out there for consumers to buy right now, and the steady rise in home prices plus increasing mortgage rates create a perfect storm in terms of affordability.”

Lease Property Update

Houston’s lease market enjoyed a strong January, most likely fueled by consumers that have postponed homebuying plans until the market yields a more plentiful and affordable supply of housing. Single-family lease homes rose 7.8 percent year-over-year. Leases of townhomes and condominiums increased 2.6 percent. The average single-family rent went up 9.7 percent to $2,070 while the average rent for townhomes and condominiums jumped 11.9 percent to $1,801.

January Monthly Market Comparison

After turning 2021 into a record year, the Houston real estate market had a strong opening to 2022 with January single-family home sales up 7.1 percent year-over-year. Most of the other monthly measurements were also positive. Pending sales jumped 15.7 percent. However, total active listings — or the total number of available properties —remained down 14.2 percent as a result of steady homebuying trends throughout 2021.

Single-family homes inventory slid to a 1.4-months supply versus 1.7 months last January. Over the past 12 months, the highest inventory level has been a 1.8-months supply in August 2021. The lowest was 1.3 months from March through May of last year. Housing inventory nationally stands at a 1.8-months supply, according to the latest report from the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales rose 7.1 percent in January with 6,451 units sold throughout the greater Houston area compared to 6,024 a year earlier. Strong sales volume among high-end homes pushed up pricing. The median price climbed 17.9 percent to $310,000 while the average price rose 16.2 percent to $377,738. Both are the highest prices ever for a January, but are well below overall record highs set during 2021.

Days on Market, or the actual time it took to sell a home, fell from 48 to 39 days. Inventory registered a 1.4-months supply compared to 1.7 months a year earlier. That is the second lowest inventory level of all time. The current national inventory figure stands at 1.8 months, as reported by NAR.

Broken out by housing segment, January sales performed as follows:

- $1 - $99,999: decreased 36.0 percent

- $100,000 - $149,999: decreased 40.6 percent

- $150,000 - $249,999: decreased 34.4 percent

- $250,000 - $499,999: increased 36.1 percent

- $500,000 - $999,999: increased 47.1 percent

- $1M and above: increased 52.2 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,213 in January. That was up 8.3 percent from the same month last year. The average sales price rose 16.4 percent to $374,093 while the median sales price climbed 17.6 percent to $300,000.

For HAR’s Monthly Activity Snapshot (MAS) of the January 2022 trends, please click HERE to access a downloadable PDF file.

Townhouse/Condominium Update

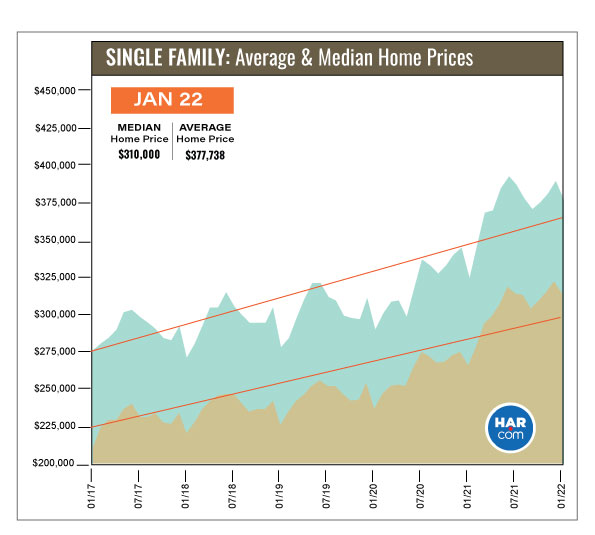

Sales of townhouses and condominiums increased for the 17th consecutive month in January, rising 24.7 percent with 566 closed sales versus 454 a year earlier. The average price jumped 14.7 percent to $241,605 and the median price increased 18.3 percent to $207,700. Inventory fell from a 3.3-months supply to 1.6 months.

Houston Real Estate Highlights in January

- Single-family home sales staged a strong open to the new year with January volume up 7.1 percent year-over-year;

- Days on Market (DOM) for single-family homes dropped from 48 to 39;

- Total property sales rose 9.3 percent with 8,134 units sold;

- Total dollar volume increased 28.1 percent to $2.9 billion;

- The single-family average price rose 16.2 percent to $377,738, the highest ever for a January;

- The single-family median price increased 17.9 percent to $310,000 – also a January record;

- Single-family home months of inventory registered a 1.4-months supply, down from 1.7 months year-over-year and below the national inventory of 1.8 months;

- Townhome/condominium sales rose 24.7 percent with the average price up 14.7 percent to $241,605 and the median price up 18.3 percent to $207,700;

- Single-family home rentals rose 7.8 percent with the average rent up 9.7 percent to $2,070;

- Townhome/condominium leases increased 2.6 percent with the average rent up 11.9 percent to $1,801.