Cost to buy a house calculator

Are you ready to take the exciting leap into homeownership, but feeling unsure about the additional costs involved beyond the purchase price?

We understand that navigating closing costs can be overwhelming, which is why we're excited to introduce you to a powerful tool that can help demystify the process.

How Much Are Closing Costs for Buyer?

https://thegiffordgroup.net/closing-cost-calculator

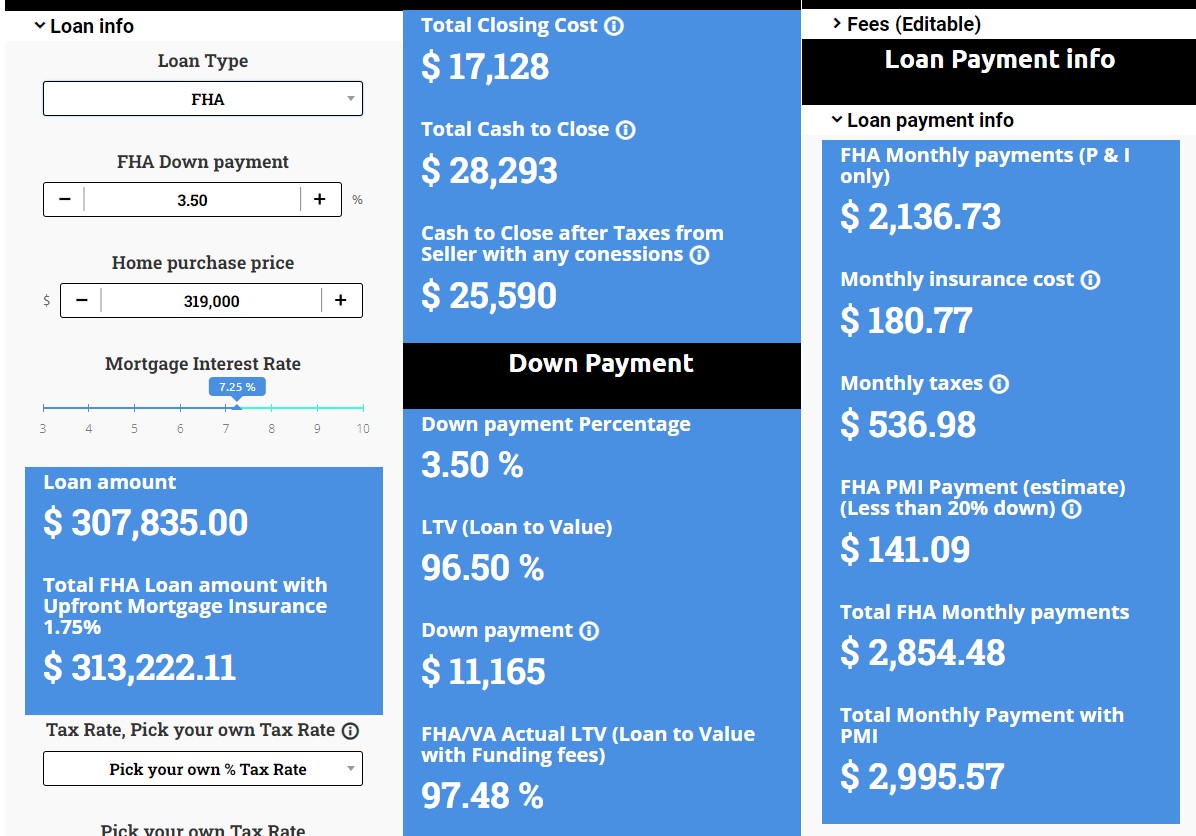

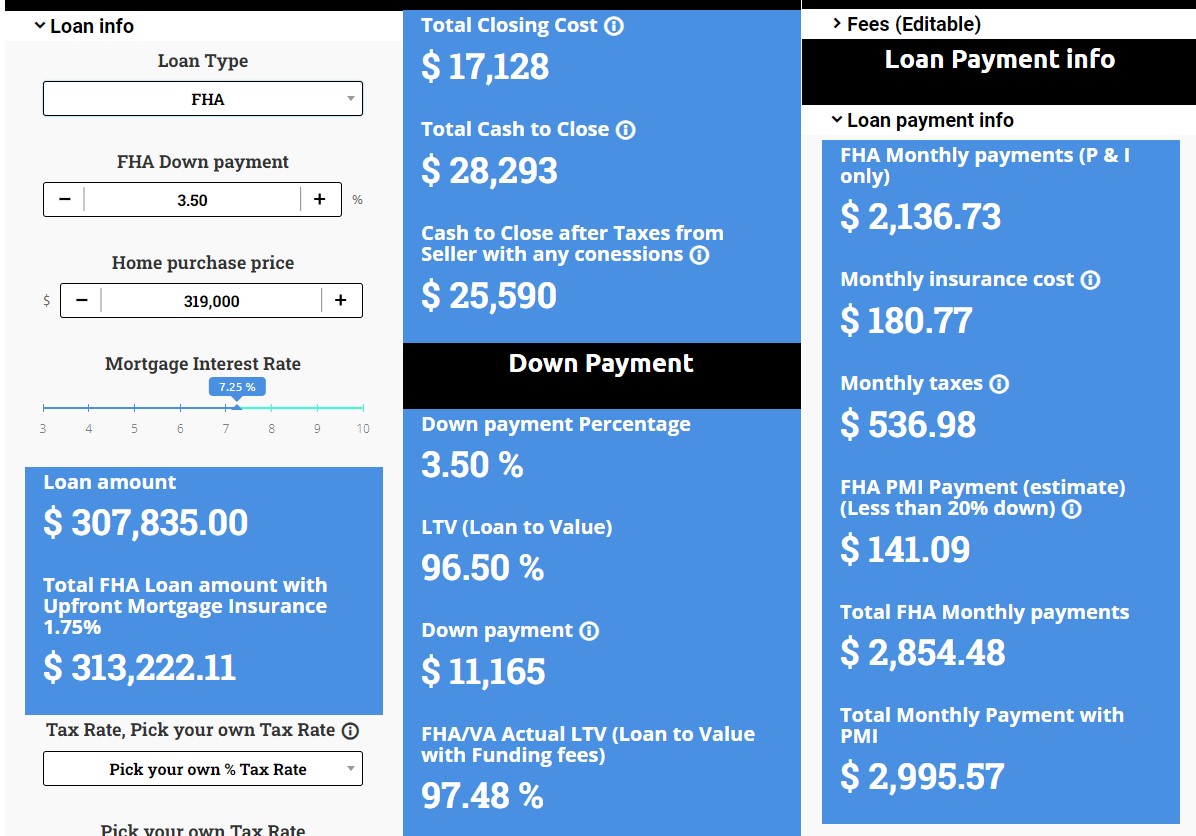

Introducing our updated closing cost calculator, designed to give you a clearer picture of the expenses you might encounter when purchasing a property. Whether you're a first-time homebuyer or a seasoned investor, having an estimate of your closing costs can help you budget more effectively and avoid any surprises along the way.

Different Loan Types

Our calculator allows you to customize various factors to tailor the estimate to your specific situation. From choosing your loan type – whether it's conventional with a down payment, FHA, or VA – to inputting the purchase price, down payment amount, interest rate, and loan term, you have the flexibility to adjust the parameters based on your preferences and financial circumstances.

THE GIFFORD GROUP

The Gifford Group is here to simplify your real estate journey by offering a comprehensive suite of services that cover everything from buying and selling properties to understanding financial implications.

Let's explore why The Gifford Group is your ultimate one-stop shop for all your real estate needs.

When considering homeownership, it's essential to be aware of closing costs, typically falling between 2% and 5% of your mortgage loan amount.

However, it's crucial not to overlook the impact of the down payment.

Factoring in the down payment can elevate the total cash requirement to approximately 7%-9% of the purchase price. Understanding these financial aspects is vital for a well-informed home buying process

- Down payment, 3-20%, (typical is only 7-8% down of purchase price)

- Loan origination, .5-1% (of the loan amount)

- Points/Discount fees, (pay to receive a lower interest rate, Typically .25-2% of the loan amount)

- Home inspection, $350-$450

- Appraisal, $400-$850

- Credit report $65-135

- Private mortgage insurance premium, Varies, .55-2.5% of loan amount (based on credit)

- Insurance escrow for homeowner’s insurance, $3000-$4000 a year in Texas (Varies on location)

- Property tax escrow, if being paid as part of the mortgage. (4 months) Use Property Tax Calculator

- Deed recording $100-$200

- Title insurance policy premiums Varies (based our loan amount, set by State, Calculator can do it for you)

- Land survey $400-$1500

- Notary fees $65-$125

- Prorations for your share of costs, such as utility bills and property taxes

Types of Financing:

Explore different financing options, including:

- Conventional Loans: requiring a 5% down payment and a 620 minimum credit score, with the possibility of stopping mortgage insurance after reaching a 78% loan-to-value.

- FHA Loans: backed by the Federal Housing Administration, featuring a 3.5% down payment and a minimum credit score of 580, with ongoing mortgage insurance until refinancing, moving, or loan payoff.

- VA Loans: exclusive to veterans, with no down payment required and varying credit score requirements, offering ongoing mortgage insurance relief after closing.

- USDA Loans: designed for low-to-moderate-income buyers in rural areas, requiring zero down payment and often having a credit score requirement of 640.

-

Mortgage offers loan amounts up to $3 million for homes that price outside of the conforming loan limits. The limit for conforming loans supported by Fannie Mae and Freddie Mac, $766,500 in 2024.

Property Tax Estimate

Estimate Property Tax Expenses:

Utilize accurate data to provide you with an estimate of your potential property tax obligations. By inputting a few key details about your desired property, you'll receive an instant estimate, saving you time and effort. We Include School, County, and M.U.D tax with Property Tax after Exemptions along with Disability Exemptions. Read more about MUD Taxes here.

Buyer's Guide Resource, Download Instantly

One of the standout features of our calculator is the ability to modify closing cost fees. We understand that not all transactions are the same, and fees for services such as appraisal, title insurance, and lender charges can vary. With our tool, you can input the specific fees applicable to your transaction or adjust the defaults to better reflect your situation.

To get started, simply visit The Gifford Group Closing Cost Calculator and enter the requested information. Within moments, you'll receive an estimate of your closing costs, empowering you to make informed decisions throughout the homebuying process.

At The Gifford Group, we're committed to providing you with the resources and support you need to achieve your homeownership goals. Whether you're exploring properties in Houston or beyond, our team is here to help you every step of the way. If you are ready to Apply today!

Take the first step towards homeownership today and let our closing cost calculator guide you on your journey. Happy house hunting!